Now Reading: Case Study: BPMN for Insurance Claim Processing

-

01

Case Study: BPMN for Insurance Claim Processing

Case Study: BPMN for Insurance Claim Processing

This case study demonstrates the application of Business Process Model and Notation (BPMN) in streamlining an insurance claim processing system. We will analyze a simplified claim process, highlighting key BPMN elements and their impact on efficiency and clarity.

1. Introduction: The Need for Clarity and Efficiency

Insurance claim processing often involves complex workflows with multiple stakeholders, various data inputs, and regulatory requirements. Traditional methods of documenting these processes, such as flowcharts or textual descriptions, can be ambiguous and difficult to maintain. This leads to:

- Miscommunication: Between business analysts, developers, and stakeholders.

- Inefficiency: Due to bottlenecks, redundancies, and lack of process visibility.

- Errors: In claim handling, leading to customer dissatisfaction and financial losses.

BPMN provides a standardized graphical notation for representing business processes, enabling clear communication and facilitating process improvement initiatives.

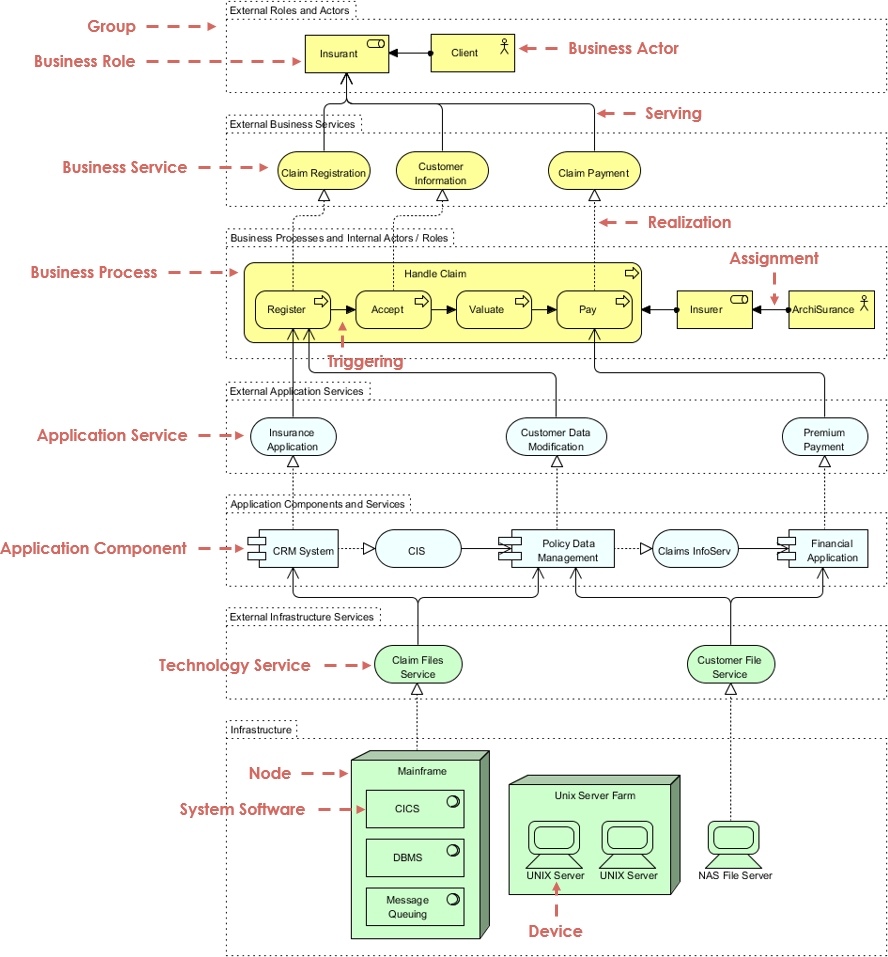

2. The Case: ArchiSurance Claim Processing

ArchiSurance, a fictional insurance company, faces challenges in managing its claim process. The existing system is slow, error-prone, and lacks transparency. The company decides to adopt BPMN to model and optimize its claim process.

3. Modeling the “Handle Claim” Process with BPMN

The core process, “Handle Claim,” is broken down into several sub-processes and tasks, represented using BPMN elements:

3.1. Core Elements and Their Usage:

- Start Event: Represented by a thin circle, triggering the start of the “Handle Claim” process. In this case, it’s the “Claim Registration” task.

- Activities: Represented by rounded rectangles, denoting tasks or sub-processes. Examples include “Accept Claim,” “Assess Damage,” and “Authorize Payment.”

- Gateways: Represented by diamonds, controlling the flow of the process based on conditions. The “Assess Damage” task is followed by an Exclusive Gateway (XOR) to determine if the claim is valid or not.

- Sequence Flows: Represented by solid arrows, showing the order of activities. For instance, the sequence flow connects “Accept Claim” to “Assess Damage.”

- Exclusive Gateway (XOR): Represented by a diamond with an “X” inside, used to model decision points where only one path can be taken.

- Parallel Gateway: Represented by a diamond with an “+” inside, used to model situations where multiple activities can be performed concurrently.

- Inclusive Gateway: Represented by a diamond with a circle inside, used to model situations where one or more paths can be taken depending on conditions.

- End Event: Represented by a thick circle, marking the completion of the process.

3.2. Process Flow Description (Refer to the Diagram):

- Claim Registration: The process starts with the registration of a new claim.

- Accept Claim: The claim is reviewed and accepted for processing.

- Assess Damage: The extent of the damage is assessed.

- Exclusive Gateway (Claim Valid?): Based on the assessment, the gateway directs the process to either “Authorize Payment” (if valid) or “Reject Claim” (if invalid).

- Authorize Payment: If the claim is valid, payment is authorized.

- Parallel Gateway (Notify Customer & Update Records): After payment authorization, two activities occur in parallel: notifying the customer about the payment and updating internal records.

- Reject Claim: If the claim is invalid, it is rejected, and the customer is notified.

- End Event: The process ends after payment or rejection.

4. Benefits of Using BPMN:

- Improved Communication: BPMN diagrams provide a common language for all stakeholders to understand the claim process.

- Increased Efficiency: By visualizing the process, bottlenecks and redundancies can be easily identified and eliminated.

- Reduced Errors: Clear process definitions minimize ambiguity and reduce the likelihood of errors in claim handling.

- Enhanced Collaboration: BPMN facilitates collaboration between business analysts, developers, and stakeholders.

- Better Process Management: BPMN diagrams can be used to monitor, analyze, and continuously improve the claim process.

- Automation Potential: BPMN models can be used to generate executable code for automating parts of the process.

5. Challenges and Considerations:

- Complexity: For very complex processes, BPMN diagrams can become large and difficult to manage.

- Tooling: Choosing the right BPMN tool is crucial for effective modeling and process execution.

- Training: Stakeholders need to be trained on BPMN notation and methodology.

- Maintenance: BPMN diagrams need to be kept up-to-date as the process evolves.

6. Conclusion:

This case study demonstrates the value of BPMN in streamlining and improving insurance claim processing. By providing a clear and standardized representation of the process, BPMN enables ArchiSurance to enhance communication, increase efficiency, reduce errors, and improve customer satisfaction.

While challenges exist, the benefits of using BPMN for process modeling and management outweigh the drawbacks. As organizations increasingly rely on process-driven operations, BPMN will continue to play a crucial role in enabling process clarity and agility.

BPMN References

- Comprehensive Guide to Visual Paradigm for Business Process Modeling

- Streamlining Business Processes with Visual Paradigm’s BPMN Business Process Modeling Software

- Visual Paradigm: Your Comprehensive Solution for Integrated Enterprise Modeling

- Demystifying BPMN: A Comprehensive Guide to Business Process Modeling

- Navigating Business Processes with BPMN: A Visual Odyssey

- Visual Paradigm: The Ultimate All-in-One Visual Modeling Platform for Enterprise Architecture and Software Design

- Top Visual Paradigm Tools for Business Process Modeling

- Visual Paradigm: The Premier Tool for ArchiMate EA Modeling

- Mastering Visual Paradigm’s BPMN Tool: A Step-by-Step Learning Guide

- Simplify Business Process Modeling with Visual Paradigm’s BPMN Tools

- BPMN — Quick Guide

- BPMN in a Nutshell — with Free Online BPMN Tool & Examples

- A Comprehensive Guide to BPMN

- Modeling As-Is and To-Be Processes

- How to Perform Gap Analysis with BPMN?

- Visual Paradigm: A Comprehensive Suite for IT Project Development and Digital Transformation

- Introduction to BPMN Part I – Visual Paradigm

- BPMN Tutorial with Example – The Leave Application Process

- How to Draw BPMN Diagram?

- BPMN Activity Types Explained

- How to Create BPMN Diagram?

- How to Develop As-Is and To-Be Business Process?

- How to Draw BPMN 2.0 Business Process Diagram?

- Introduction to BPMN Part IV – Data and Artifacts

- Introduction to BPMN Part III – Flow and Connecting Objects

- How to Draw BPMN Conversation Diagram?

- Business Process Diagram Example: Sequence

- Business Process Diagram Example: The Nobel Prize